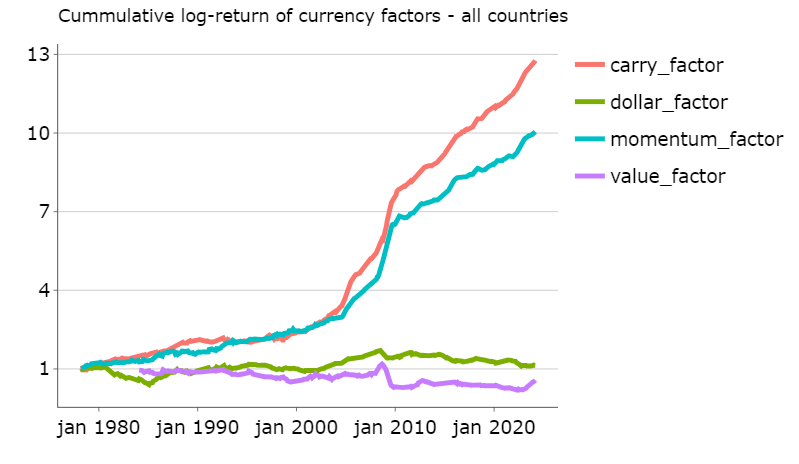

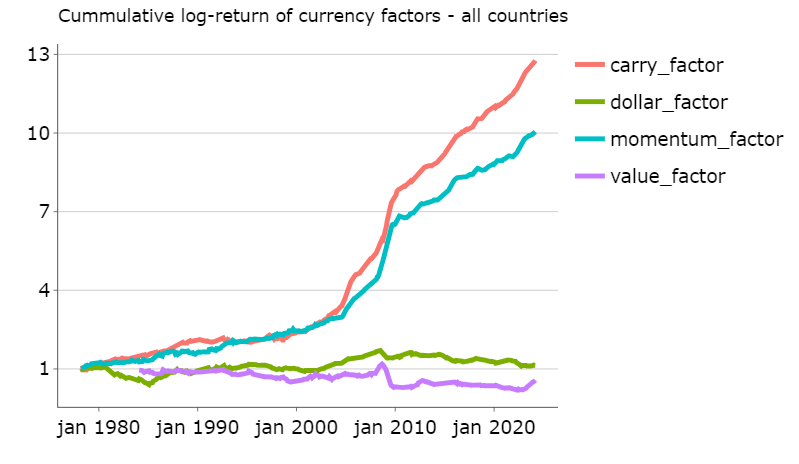

We compute currency risk factors and portfolios from the FX literature based on the following works: Lustig, Roussanov and Verdelhan (2011), Menkhoff, Sarno, Schmeling and Schrimpf (2012) and Menkhoff, Sarno, Schmeling and Schrimpf (2017)

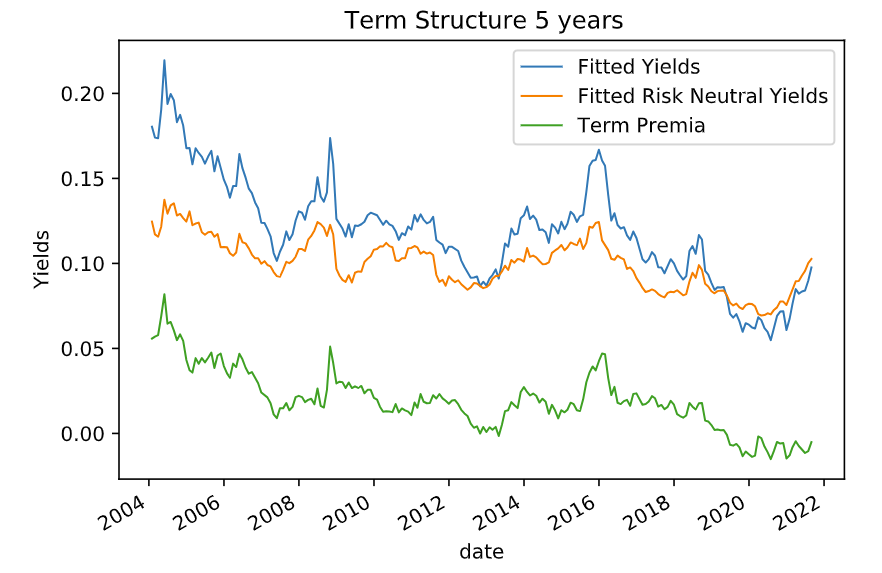

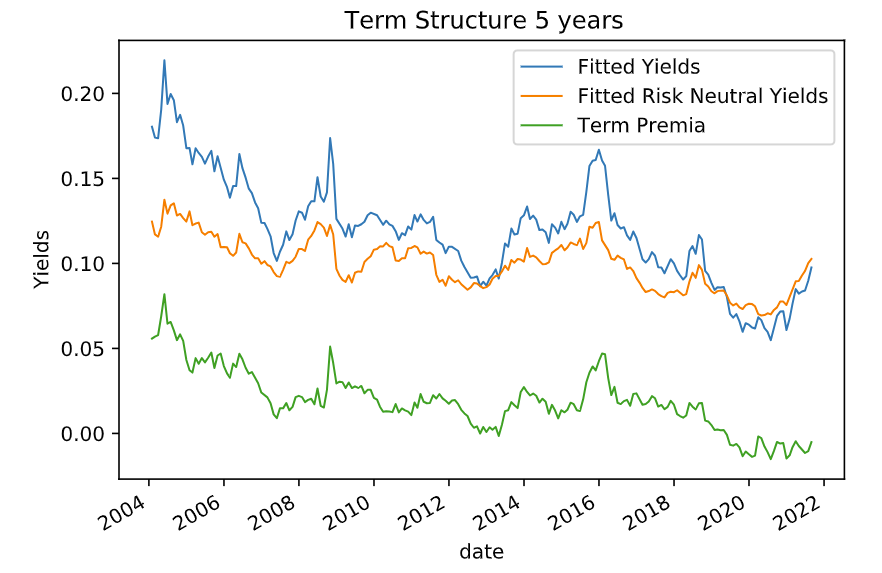

We compute Term Premium for Brazilian interest rate term structure by applying Adrien, Crump and Moench (2013) methodology.

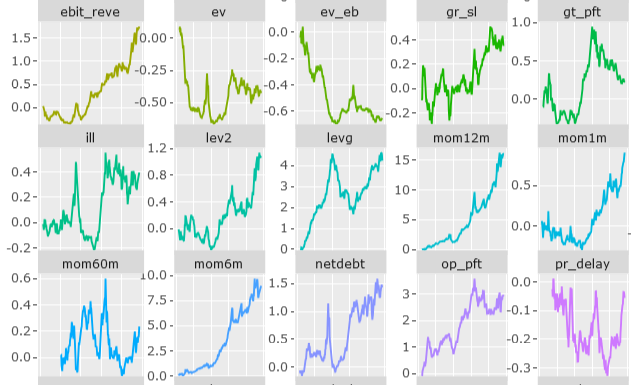

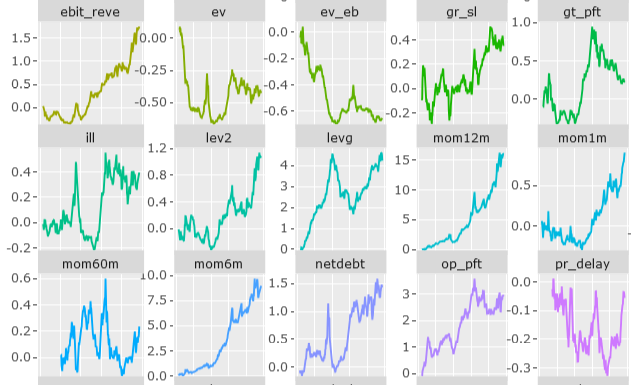

We investigate the impact of firm characteristics on stock returns in the Brazilian financial market, considering a long list of characteristics found be relevant in the U.S. market. Employing Fama-MacBeth regressions, alongside machine learning techniques, we examine over 24 firm-level characteristics. Our findings highlight the stronger influence of price-related metrics, such as momentum, liquidity, size and volatility, over accounting variables.

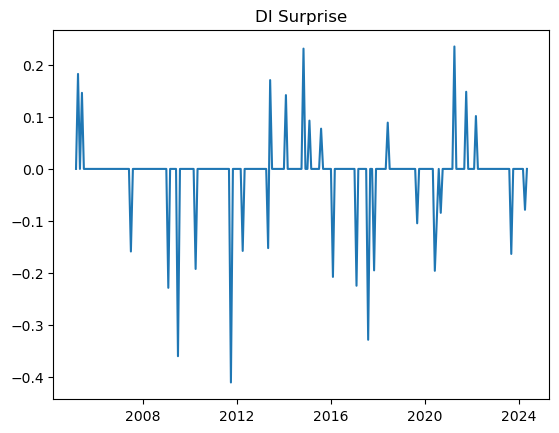

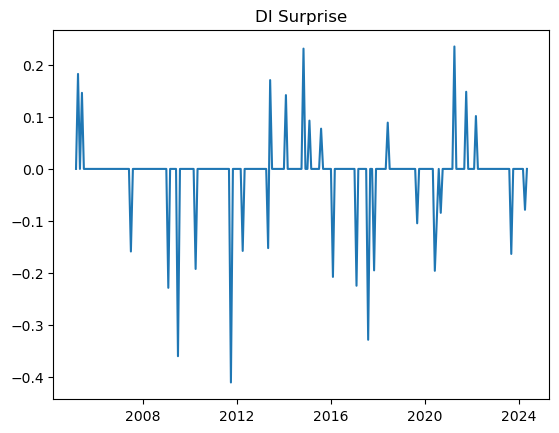

Presents a methodology to detect MP Shocks in Brazil using daily frequency data, building on Ferreira Neto's adaptation (2023) of Gertler and Karadi's (2015) framework.